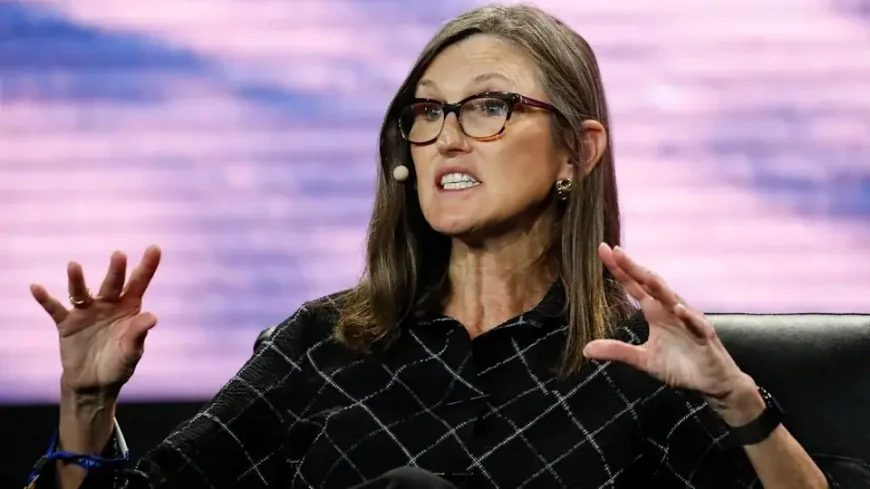

Cathie Wood bets on ETH Treasury Bitmain after Ethereum

Cathie Wood said Ark Invest's bullish target for Bitcoin has been reduced from $1.5 million to $1.2 million. • Ark Invest purchased 240,507 shares of Ethereum Treasury Bitmain Immersion. • Ethereum's decline has caused many companies to suffer millions of dollars in unrealized losses.

Cathie Wood said Ark Invest's bullish target for Bitcoin has been reduced from $1.5 million to $1.2 million.

• Ark Invest purchased 240,507 shares of Ethereum Treasury Bitmain Immersion.

• Ethereum's decline has caused many companies to suffer millions of dollars in unrealized losses.

Cathie Wood's Ark Invest has increased its investment in Ethereum-focused assets and purchased 240,507 shares of ETH Treasury Bitmain Immersion.

This acquisition comes after the star stock picker drastically cut her long-term Bitcoin (BTC) forecast, claiming that the rise of stablecoins was causing the crypto's value to fall.

Wood remains consistently optimistic about ETH Treasury.

Wood's investment firm, known for supporting disruptive technologies, has purchased Bitmain shares in several Ark ETFs, signaling renewed interest in ETH treasury strategies.

Under the leadership of Thomas "Tom" Lee, Bitmain has established itself as a pioneer of the "Ethereum Treasury" model.

With Wood's growing confidence in Ethereum's future role, Ark has purchased Bitmain shares several times this year.

Speaking with Ark Invest's Cathie Wood on her podcast in October, Lee stated that the company is approximately the 470th largest US company by market capitalization.

This comment comes after BMNR shares rose from around $5 to a peak of $161, stabilizing in the mid-$50s by October 10, 2025, after a year-to-date increase of nearly 700%.

Lee told the podcast that once their upcoming staking solution is live, the company could generate a pre-tax return of 2.79%, potentially ranking among the 800 most profitable firms in the US.

Wood Cuts Bitcoin Forecast

In an interview with CNBC this week, Wood said that Ark's bullish forecast for Bitcoin has been reduced from approximately $300,000 to $1.2 million by 2030, and she also pointed out that stablecoins are somewhat reducing Bitcoin's previously envisioned utility in emerging markets.

"Given what's happening with stablecoins, which are serving emerging markets in the same way we envisioned Bitcoin, I think we can lower this bullish forecast for stablecoins to just $300,000," she said.

She explained that the rise of dollar-pegged digital assets is changing the way emerging economies access financial infrastructure.

"Stablecoins are cash, they are dollars. Bitcoin is a global monetary system," Wood said. "It's the harbinger of a new asset class. And in a way, it's a completely new technology."

Describing Bitcoin as "digital gold," Wood said that the rise in gold prices since Ark's first forecast has complicated direct comparisons.

Nevertheless, he emphasized that the broader digital asset ecosystem is expanding rapidly.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0