Where does the market for blockbuster weight loss drugs stand today

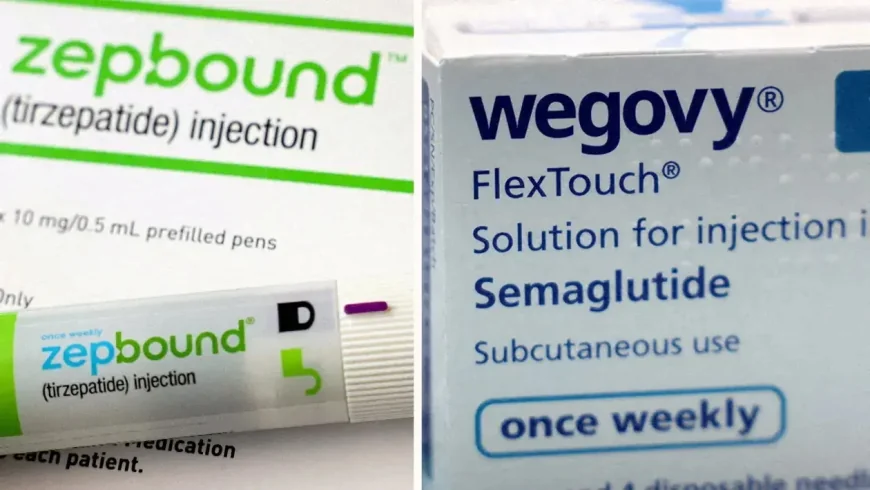

• The market for blockbuster weight loss drugs is entering a new phase of growth. • Eli Lilly and Novo Nordisk are both focused on gaining market share, increasing supply, testing new uses for their drugs, and bringing the next wave of obesity drugs to patients

• The market for blockbuster weight loss drugs is entering a new phase of growth.

• Eli Lilly and Novo Nordisk are both focused on gaining market share, increasing supply, testing new uses for their drugs, and bringing the next wave of obesity drugs to patients.

• Behind them are numerous drugmakers vying for a share of a market that some analysts estimate could reach nearly $100 billion by the end of the decade.

• But questions remain about insurance coverage, drug pricing, copycat treatments, and the role of pills.

• Demand for blockbuster weight loss and diabetes drugs has yet to be met.

• From new competition to new uses, the market is rapidly entering a new phase of growth. But factors like insurance coverage, pricing, copycat drugs, and the development of new pills will ultimately determine how far these treatments reach.

• Eli Lilly and Novo Nordisk remain the dominant players, as demand for their weekly injections shows little sign of slowing. Eli Lilly, during its third-quarter earnings report on Thursday, reported gaining market share for the fifth consecutive quarter, and its drugs accounted for nearly six out of ten injectable medications in the obesity and diabetes category.

• But both companies are focused on increasing supply, testing new uses for their drugs, and bringing the next wave of obesity drugs, including more convenient pills, to patients.

• Behind them are a range of drugmakers—from biotech startups to pharmaceutical giants—vying for a share of a market that some analysts estimate could be worth nearly $100 billion by the end of the decade. There could be considerable room for new entrants: McKinsey estimates that 25 million to 50 million American patients could use GLP-1 by 2030.

• Nearly every major pharmaceutical company has staked itself on obesity drugs, often through deals with smaller developers, including those based in China. While some experimental drugs are far ahead of others, all may take years to reach the market, and their competitiveness will depend on future data demonstrating their effectiveness and how well they are tolerated by patients.

• As competition grows, many patients still struggle to access these drugs. Some insurance companies, including Medicare, do not cover GLP-1 for obesity, which can cost around $1,000 per month before deductibles.

• Eli Lilly and Novo Nordisk have launched discount programs for cash-paying patients to bridge this gap, and more employers are offering coverage as GLP-1s are proving to have additional health benefits, such as treating obstructive sleep apnea and chronic kidney disease, as well as reducing cardiovascular risk.

• Nevertheless, some patients continue to use cheaper, copycat versions of branded treatments—even though these options are limited in many cases. Although there is no longer a shortage of Novo Nordisk and Eli Lilly drugs, both companies are cracking down on pharmacies, medspas, and other suppliers that mass-produce and market cheap compounded GLP-1s.

• Although new competitors and lower-cost pills may make the drugs accessible to more patients, access will largely depend on how companies like Novo Nordisk and Eli Lilly price their drugs in the coming years.

• Here's what you need to know about the state of the rapidly growing weight loss drug market.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0