Bessent Plans Gradual Changes to US Treasury Debt Sales

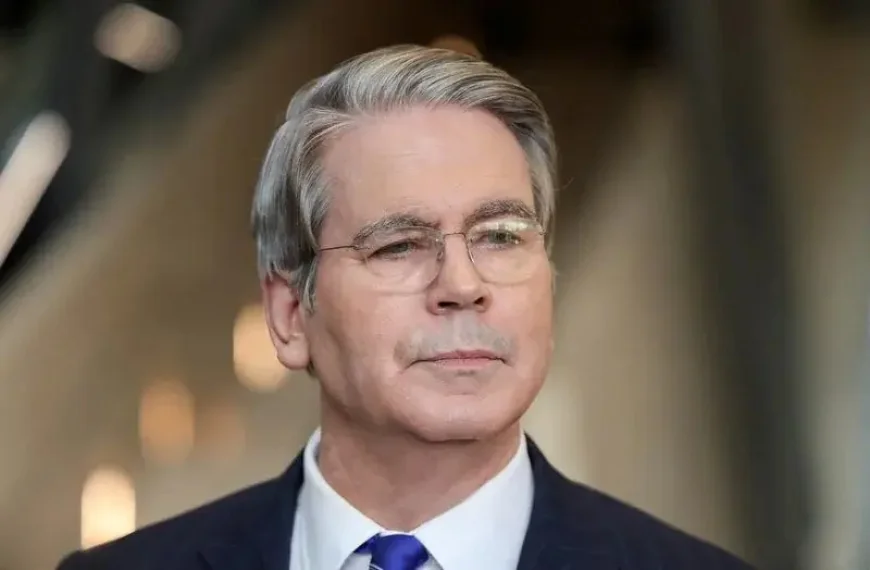

US Treasury Secretary Scott Bessant said on Wednesday that he expects continued strong demand in the Treasury debt market and that the department will gradually adjust the size of coupon auctions to avoid market disruption.

Bessant said at the Federal Reserve Bank of New York's Treasury Markets Conference that the Treasury will continue to offer "regular and predictable" coupon securities to maintain a standard of stability in the Treasury market amid changing borrowing needs.

"For Treasury auctions to be successful, we need to be attentive to market participants, but we will not change our overall protocols," Bessent said.

"We will remain analytical in our decision-making, adjusting issuance gradually to avoid market disruptions. We will provide public forward guidance to the extent practicable. And we will regularly canvass the market for feedback on how our issuance decisions are being received," he added.

Bessant said that demand for Treasury bills is growing due to money market funds and stablecoin providers, as well as banks expanding their Treasury holdings. He added that the Treasury supports reforms to banks' supplementary leverage ratios, which will further increase demand.

Bessent reiterated that Treasury will not need to change the size of coupon auctions for at least the next several quarters.

"Existing financing capacity from current auction sizes and robust demand in the bill market have given us flexibility to manage our upcoming potential borrowing needs," he said.

He said the Treasury would not have to make an immediate decision on changes to the auctions due to the flexibility provided by the slight reduction in the US deficit and the Federal Reserve's recent announcement that it would begin purchasing Treasury bills with proceeds from its MBS holdings.

What's Your Reaction?

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0