LONDON — European stocks are expected to start the last trading month of the year in negative territory.

Regional markets closed in positive territory on Friday, capping a volatile month for stocks as concerns about high AI valuations resurfaced.

Uncertainty over monetary policy weighed on sentiment last month, but investors now expect the U.S. Federal Reserve to lower interest rates at its meeting on December 9-10. According to the CME FedWatch tool, traders see an 87.4% chance of a quarter-point rate cut.

European investors will be closely monitoring the progress of a peace deal for Ukraine this week as U.S. Special Envoy Steve Witkoff heads to Moscow for talks with Russian President Vladimir Putin and other Kremlin officials.

These talks come after Ukraine announced its principal approval of a U.S.-backed 19-point peace plan. This plan is a revised version of an initial 28-point plan secretly developed by the U.S. and Moscow, which appeared to favor Russia.

Ukrainian and U.S. officials, led by U.S. Secretary of State Marco Rubio, held further talks in Florida over the weekend. Rubio said the talks were "very productive" but more work remains to be done.

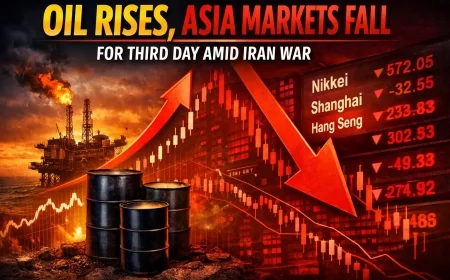

Asia-Pacific markets started December mixed as traders analyzed new manufacturing data from China, which showed a sudden decline in Chinese factory activity in November.

Meanwhile, U.S. stock futures were little changed on Sunday night after a good week, as traders prepared to end 2025 as a strong year.

Seasonality also favors Wall Street. According to the Stock Trader's Almanac, the S&P 500 rose an average of more than 1% in December, making it the benchmark's third-best month of the year in records dating back to 1950.

There will be no major earnings or data releases in Europe on Monday.

Like

0

Like

0

Dislike

0

Dislike

0

Love

0

Love

0

Funny

0

Funny

0

Angry

0

Angry

0

Sad

0

Sad

0

Wow

0

Wow

0